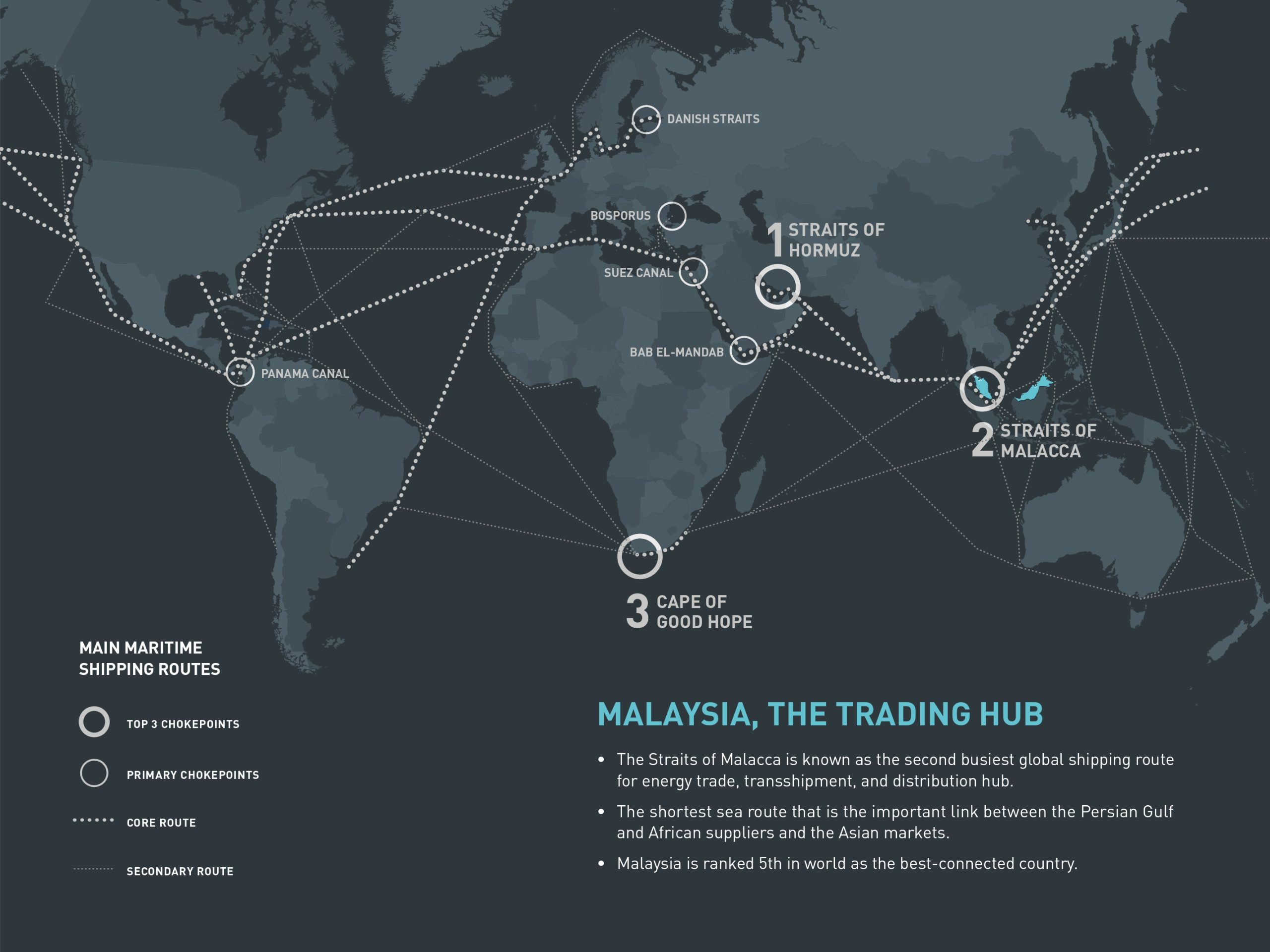

As China experiences a period of manufacturing exodus, developing nations along the global shipping lanes stand to benefit from this shift.

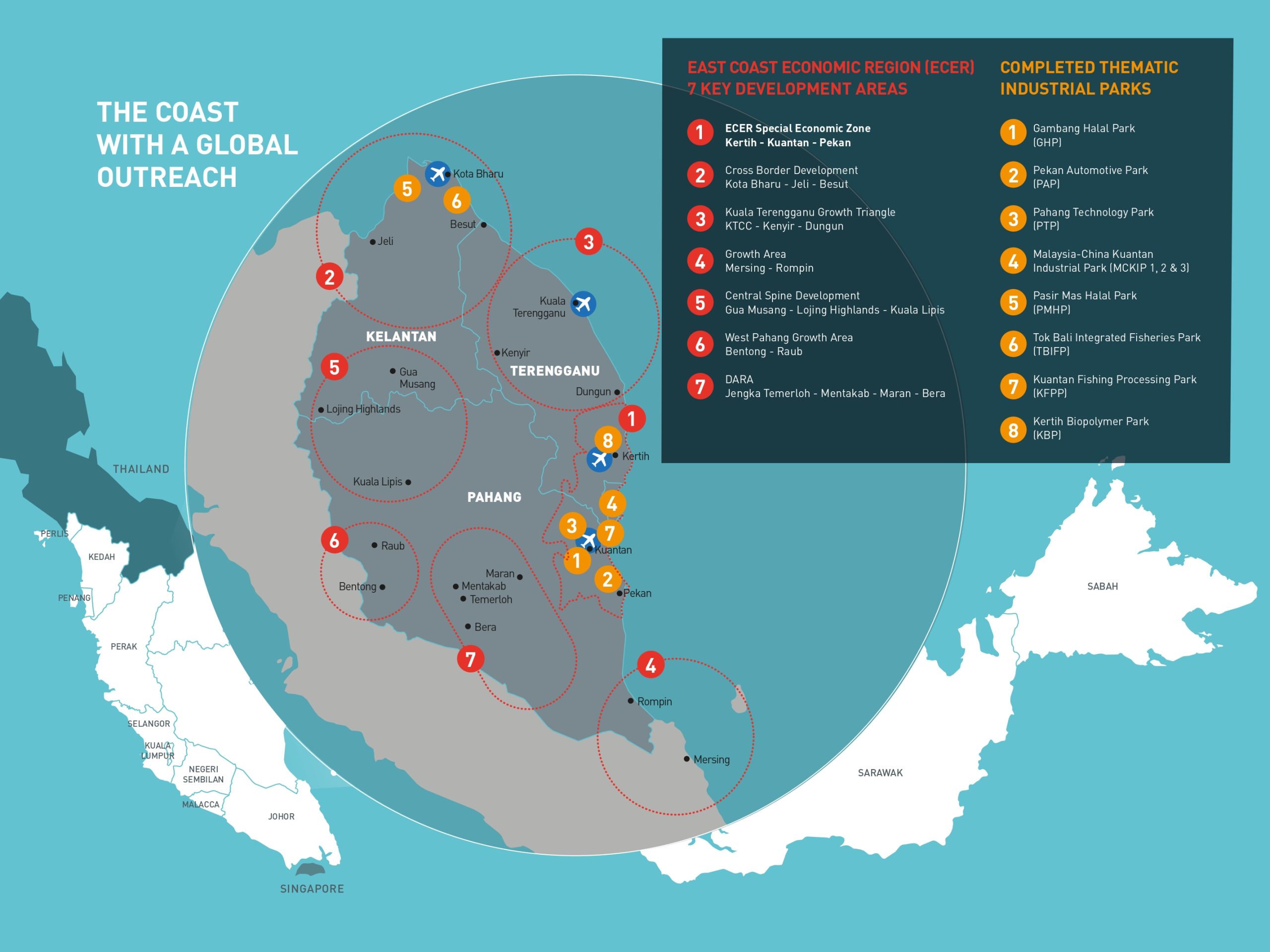

Recognising this lucrative opportunity for our nation and having received many inquiries from Chinese companies looking for favourable locations and terms to transfer their production lines, MGB’s prompt research and feasibility studies led to the setup of a JV with the Terengganu state government to develop the Kertih Terengganu Industrial Park (“KTIP”).

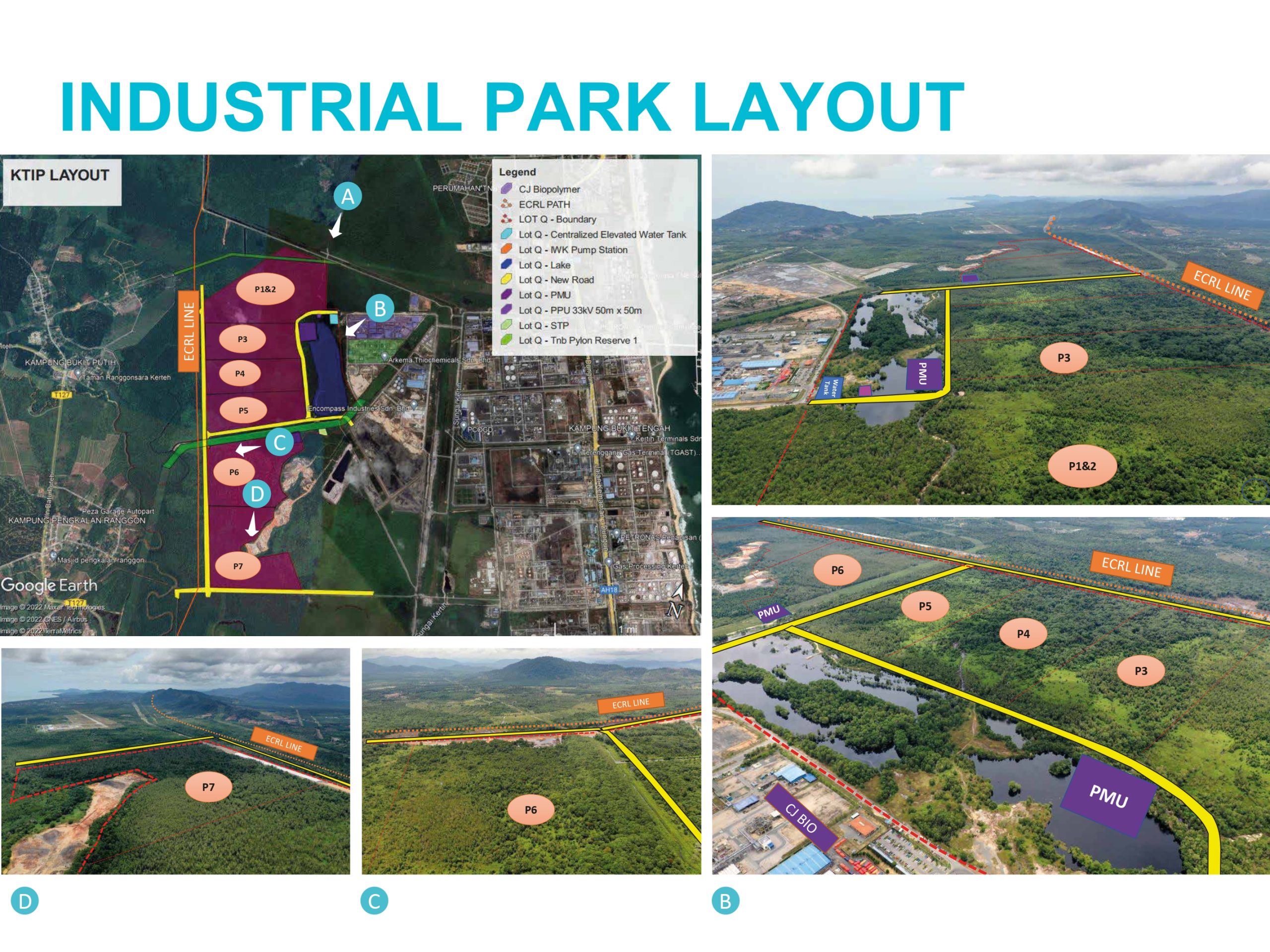

MGB was appointed as turnkey contractor to undertake the entire design, financing, construction and completion, sales and marketing, and credit administration of the heavy industrial park, which is set to be Asia’s largest second-generation bio-refinery complex at 1,000 acres. It boasts 780 acres of saleable lot with an estimated GDV of RM680 million.

Its strategic location near PETRONAS Gas Berhad’s processing plant provides the park a ready supply of greener and cheaper energy solution, as well as the catchment of ready petrochemical and industrial support infrastructure and raw materials in the area including Arkema Thiochemicals Sdn Bhd, which produces methnethiol gas, and CJ Bio Malaysia Sdn Bhd’s methionine amino acid production.

Its strategic location near PETRONAS Gas Berhad’s processing plant provides the park a ready supply of greener and cheaper energy solution, as well as the catchment of ready petrochemical and industrial support infrastructure and raw materials in the area including Arkema Thiochemicals Sdn Bhd, which produces methnethiol gas, and CJ Bio Malaysia Sdn Bhd’s methionine amino acid production.

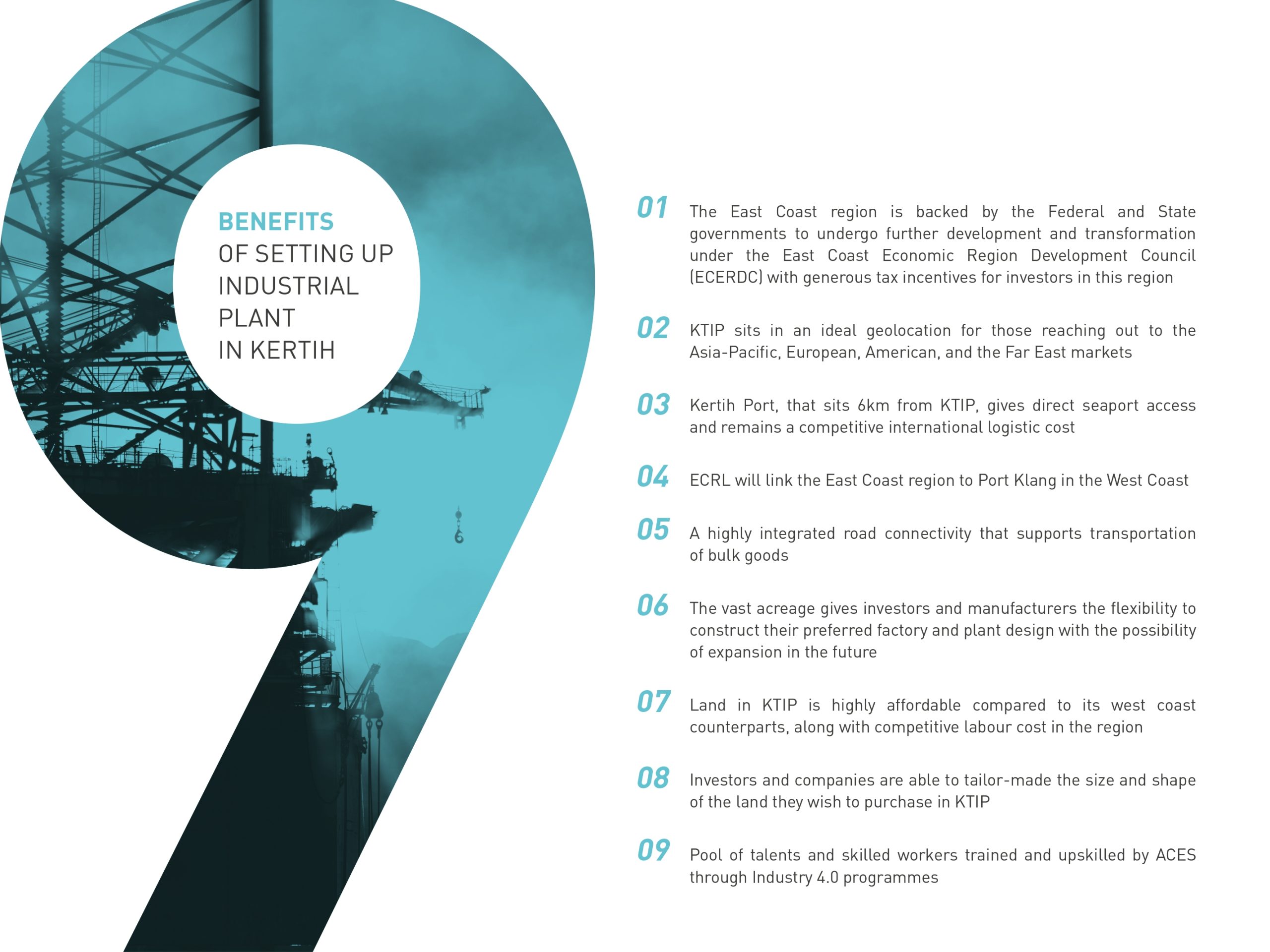

Set within the East Coast Economic Region (“ECER”), has since attracted investment commitment numbering RM5.4 billion and created over 6,000 jobs.

ECER key Incentives

Facilities nearby: