QUITE a number of Malaysian companies have found the Middle East a difficult market, replete with challenges. MGB Bhd remains undeterred, however. The construction arm of LBS Bina Group Bhd is confident its maiden overseas venture in the Kingdom of Saudi Arabia (KSA) will bring concrete benefits to the group, given that it will be concentrating on mass housing projects that are expected to have standard designs.

In fact, MGB’s efforts to develop and manufacture precast concrete products in KSA have already taken “several steps forward” as the group has secured its first international venture through a partnership with SANY Alameriah For Construction Co Ltd in KSA, MGB executive vice-chairman Tan Sri Lim Hock San tells The Edge in an interview.

KSA-incorporated SANY Alameriah is a joint-venture (JV) company between China-based SANY — one of the largest heavy equipment manufacturers in the world — and Saudi developer Alameriah.

Hock San says MGB will operate SANY Alameriah’s precast concrete plant in Jeddah, while undertaking supply and installation contracts in property development projects in KSA, valued at about SAR2.5 billion (RM3.1 billion).

“The kingdom itself has initiated reforms to its housing and property development sector. MGB’s success there will be our passport to future expansions within KSA itself and potentially other countries, be it in the Gulf Arab States or back to our backyard of Southeast Asia,” Hock San, who is also LBS executive chairman, says.

In January, MGB signed a memorandum of understanding with SANY Alameriah to install 10,000 precast concrete units for the Saudi government’s Sakani Programme within five years.

On July 27, the company signed a JV agreement with SANY Alameriah to collaborate in securing and fulfilling the latter’s contract demands for precast concrete products in KSA.

MGB group managing director Datuk Wira Joey Lim Hock Guan points out that with an annual installed capacity of 270,000 cu m, SANY Alameriah’s precast concrete factory is capable of producing industrialised building system (IBS) products worth an estimated RM600 million a year.

“On the strength of our IBS precast technology that we have innovated and curated for our construction goals since its introduction in 2018, we look forward to further opportunities abroad that we are suitably qualified and experienced [to do],” he says.

Back home, MGB has an 81% stake in MGB SANY (M) IBS Sdn Bhd, a JV company that operates precast concrete panel manufacturing plants in Alam Perdana, Selangor, and Nilai, Negeri Sembilan. Its Chinese partner, SANY, holds the remaining 19% of the JV firm.

In 2018, MGB SANY set up its first plant in Alam Perdana for RM20 million. About a year later, the second plant in Nilai was built for RM40 million. The two precast concrete plants, which have been running at full capacity, have a combined annual capacity of 100,000 cu m.

To date, MGB has completed over 6,000 property units using IBS precast concrete components. By year end, the group is expected to complete an additional 4,000 properties, bringing the total number of units to about 10,000.

“Obviously, we have been working together with SANY in Malaysia over the past five years. So, when SANY invited us to team up with SANY Alameriah in Saudi, we felt comfortable to work together with them again,” says Hock Guan, who is also the group managing director and CEO of LBS.

LBS — a Main Market-listed property group controlled by Hock San and his brother Hock Guan — is the single largest shareholder of MGB, with a controlling stake of 58.65%.

Meanwhile, MGB executive director and CEO Datuk Richard Lim Lit Chek — cousin of Hock San and Hock Guan — is the second largest shareholder of MGB as he owns 14.57% of the company. Lit Chek stresses that MGB’s immediate focus is to secure a new job in KSA within the next six months.

“We estimate our gross profit to be 10% to 15% [of] contract value for the first job we secure in KSA. We are cautiously optimistic that the Saudi venture will start making financial contributions to MGB by the second half of next year,” he says.

Under its construction and trading division, MGB is involved in design and build, civil engineering, general construction, piling activities, management consultancy activities, trading of construction materials and manufacturing of IBS precast products. The group also develops residential and commercial properties. Its top 30 shareholders include Kenanga funds, Etiqa funds, Principal DALI funds and Yayasan Guru Tun Hussein Onn.

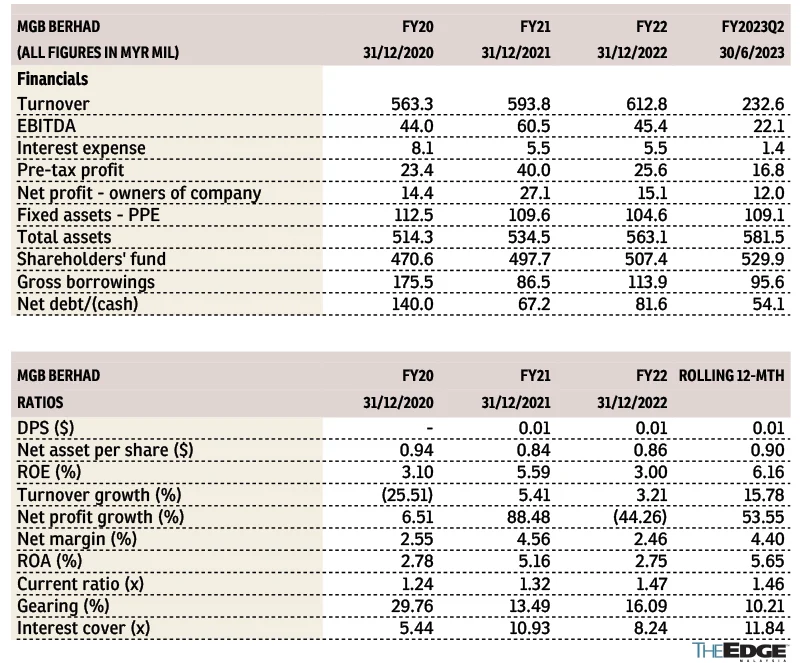

MGB’s net profit more than tripled to RM24.01 million in the first half ended June 30, 2023 (1HFY2023), from RM7.61 million in 1HFY2022, exceeding its full-year profit of RM14.76 million in the financial year ended Dec 31, 2022 (FY2022).

The stronger earnings performance was attributed to higher progressive revenue and profit contribution from its new launches and ongoing projects, as well as cost optimisation. As at June 30 this year, its net gearing ratio stood at 0.08 times.

“We are anticipating double-digit year-on-year growth in revenue and profit for the next three to five years. The main growth drivers will be our construction activities, as it is our core business and biggest revenue generator. However, we will also continue to explore and evaluate development opportunities that are feasible and in line with our goals to build affordable housing for the people,” says Hock San.

In a July 28 research report, Apex Securities Bhd lifted MGB’s top line forecast for FY2024 by 10.9% to RM1.137 billion because of potential from the new Saudi projects. The research house also raised its bottom line forecast by 3.5% to RM43.5 million.

In line with the vision of Saudi Crown Prince and Prime Minister Mohammed Salman Al Saud, KSA launched Saudi Vision 2030, which includes the Housing Programme that aims to provide housing solutions that enable Saudi families to own houses based on their personal needs and financial capabilities.

In the previous stage, the programme contributed to increasing the housing ownership rate from 47% in 2017 to 62% in 2020. In the next stage, the programme will resume its efforts to increase the percentage of Saudi families owning houses to 70% by 2030.

This will be accomplished by increasing the volume of affordable housing made available in the market. In addition, the programme will boost the attractiveness of the sector for investment by private entities.

Lit Chek says MGB sees tremendous opportunities in KSA and intends to penetrate the kingdom’s affordable housing market.

“The country has a clear vision to realise by 2030, so we want to ride the wave,” he says, although he acknowledges that some Malaysian companies faced “insurmountable challenges” in their business ventures in the Middle Eastern.

“We understand that some Malaysian companies were previously involved in main infrastructure projects that had a lot of design changes, which caused delays and, hence, disputes. But MGB is focusing on its bread-and-butter, that is construction of mass housing projects with very minimal design variances in KSA.

“As far as we are concerned, I think MGB’s risk is manageable. That is because the precast concrete factory is already completed and it is ready to commence operation any time. The heavy capital expenditure had been undertaken by SANY Alameriah, whereas MGB only needed to invest about SAR21 million for the upgrading of equipment, as well as some operating expenses,” he says.

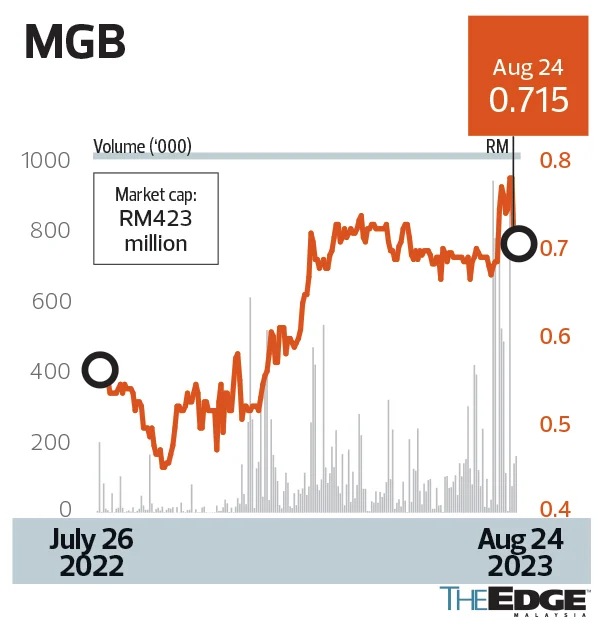

Year to date, shares of Main Market-listed MGB have gained 22 sen or 46% to close at 70 sen last Wednesday, giving it a market capitalisation of RM414.16 million. The counter is currently trading at a trailing 12-month price-earnings ratio of 13.3 times.

This article first appeared in The Edge Malaysia Weekly on August 28, 2023 – September 3, 2023